A Deep Dive Into BTFP (1)

How is it different from the traditional discount windows? Injecting 2 Trillion USD from it?

In this article, let’s dive deep into the mechanics of BTFP and what it means for the financial market and the economy. Specifically, I will address questions and concerns like:

What is a BTFP?1

How is it different from the traditional discount window?

How it will be utilized? Are banks going to do regulatory arbitrage using BTFP?

Is BTFP sufficient to contain the banking crisis?

Is it likely for rate hikes and BTFP to happen together? what are the implications?

Bank Term Funding Program (BTFP) is basically a secured financing program that allows eligible banks to get liquidity from the Federal Reserve using eligible securities on their balance sheet at the par value of these collateral securities.

I highlighted the two words above because whenever you talked about a Fed facility, it always involves of a question of what defines its range of operation, which has informative implications for its policy effect.

Compared to a normal market-based secured financing instrument (a.k.a. repurchase agreements), BTFP has the following feature:

it lasts up to 1 year, much much longer than what would happen for repos, and traditional discount window (later for this)

it values the collateral securities at their par values, while repos and discount windows value the securities at market values plus additional haircuts2

it only accepts securities that are eligible for the Fed’s open market operations, including US Treasuries, securities issued by US agencies, agency and GSE backed mortgaged-backed securities.3 But for the primary credit loans from discount window, a much wider range of securities can be used.4

finally, it is only eligible to banks that are eligible to the Federal Reserve’s primary credit lending program (one of the discount windows). BTFP is not available to banks that are eligible for the secondary credit lending program.

But why bother to emphasize the fourth point? Isn’t BTFP available to all banks?

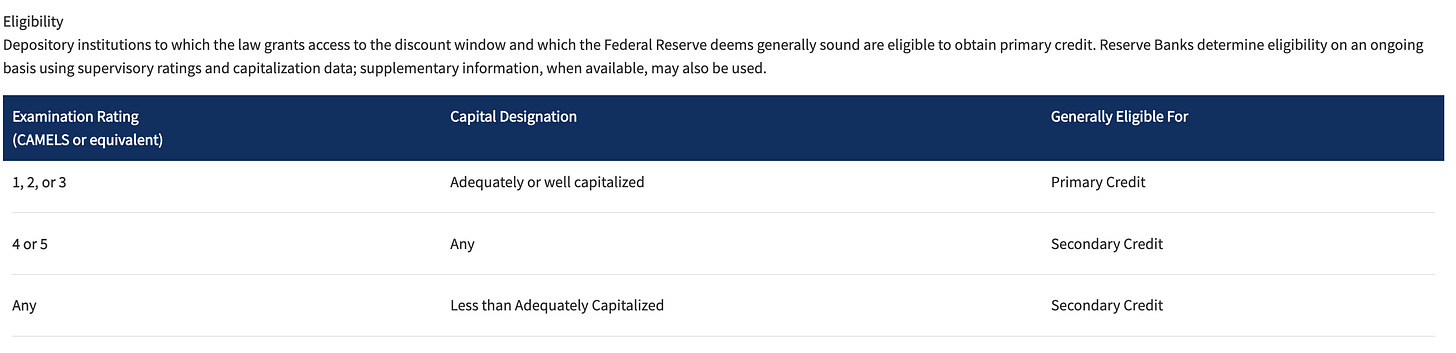

Simple answer is no, and in a surprising way: you need to be one of the “depository institutions with generally sound financial condition”5 to be able to get funds from primary credit lending program, and thus BTFP.

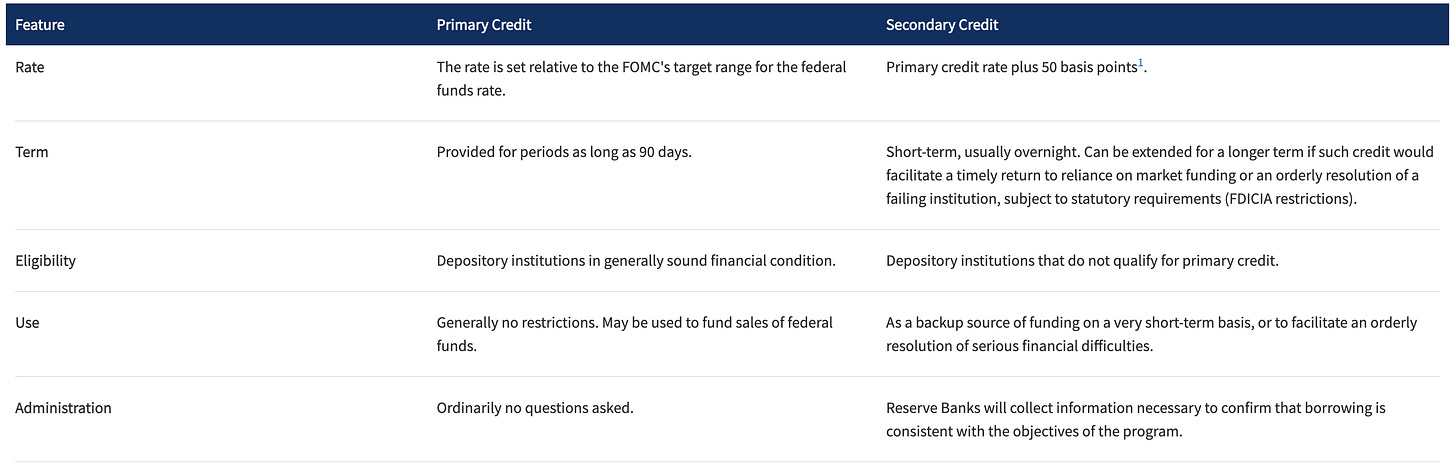

Let me pull out relevant information first, below is how the Fed defines the two lending programs:

Primary Credit

Primary credit is available to generally sound depository institutions at a rate set relative to the Federal Open Market Committee's (FOMC) target range for the federal funds rate. Depository institutions are not required to seek alternative sources of funds before requesting advances of primary credit. Primary credit may be used for any purpose, including financing the sale of federal funds. By making funds readily available at the primary credit rate the primary credit program complements open market operations in the implementation of monetary policy.

Reserve Banks ordinarily do not require depository institutions to provide reasons for requesting very short-term primary credit. Rather, borrowers are asked to provide only the minimum information necessary to process a loan, usually the amount and term of the loan.Secondary Credit

Secondary credit is available to depository institutions that are not eligible for primary credit. It is extended on a very short-term basis, typically overnight, at a rate that is above the primary credit rate. Secondary credit is available to meet backup liquidity needs when its use is consistent with a timely return to a reliance on market sources of funding or the orderly resolution of a troubled institution. Secondary credit may not be used to fund an expansion of the borrower's assets.

The secondary credit program entails a higher level of Reserve Bank administration and oversight than the primary credit program. A Reserve Bank must have sufficient information about a borrower's financial condition and reasons for borrowing to ensure that an extension of secondary credit would be consistent with the purpose of the facility.

Based on the eligibility requirement of the primary credit window, BTFP is only available to healthy banks that are not in distress.

Namely, BTFP is more like an alleviation of borrowing cost for healthy banks instead of a rescue plan for troubled banks. The banks that are in real trouble can only rely on the liquidity provided bytheir folks from the interbank market, or face another round of bank run.

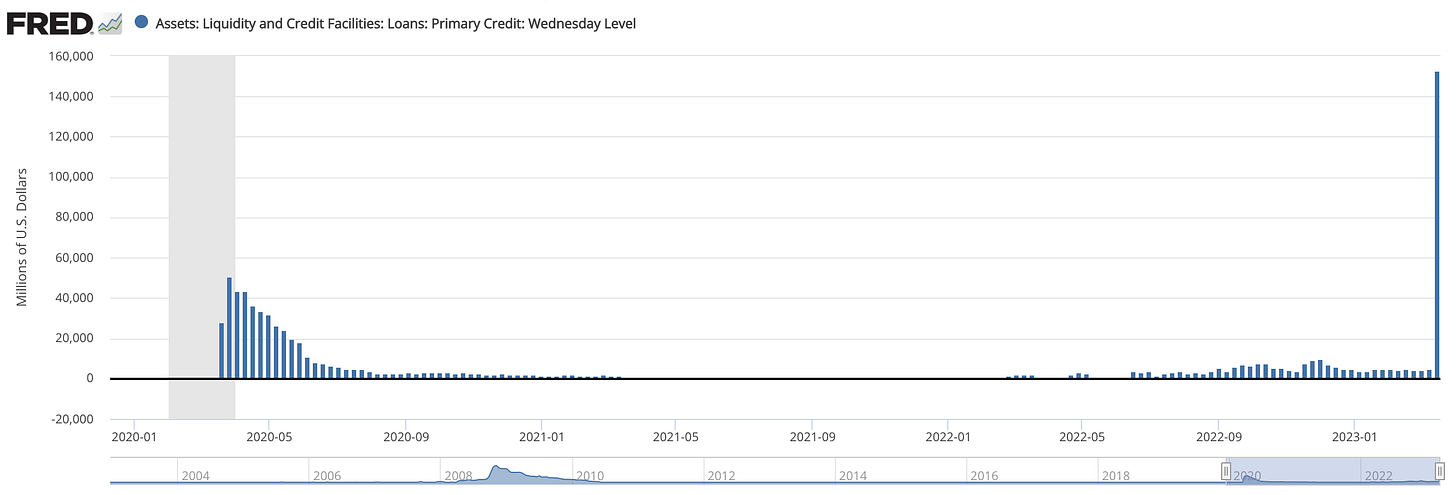

However, in the latest data we saw, the usage of BTFP is only $11.9 billion, compared with a $152.8 billion of primary credit usage (an increase of $140+ billion from previous week). I suspect this is related to the concern that raised below by someone:

30) Does a financial institution’s use of the Program raise bank supervisory concerns? (Added 3/16/2023)

No. The Board will not criticize eligible depository institutions for participating in the Program. The Board believes banks’ use of the Program can be part of sound liquidity management. The Board established the Program to make additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. The Program provides an additional source of liquidity against high-quality securities, which eliminates an institution’s need to quickly sell those securities in times of stress.

With the response above, the Fed seems to encourage more usage of BTFP. And whether this leads to a large-scale distortion to the demand of BTFP-eligible securities such as Treasuries, is the topic of our next article.

Thanks for reading.

Appendix

haircuts is the additional discount in collateral value placed on a collateral security based on their credit risk, liquidity, and price volatility.

There is a detailed list of eligible securities in the latest FAQs of BTFP https://www.federalreserve.gov/monetarypolicy/files/bank-term-funding-program-faqs.pdf

This surprises me as First Republic Bank’s problem is mainly with its large holdings in municipal bonds and a lack of liquidity. It should be able to tackle the bank run if it taps the primary credit window, unless it is not eligible to do so.